October 20–26, 2025 is National Estate Planning Awareness Week, a time to reflect on how thoughtful planning today can create a lasting impact tomorrow. At North Carolina Wesleyan University (NCWU), planned gifts have helped shape the institution’s growth, stability, and student success.

One powerful example is the gift from the Estate of Anita D. Bobbitt, which significantly expanded the John C. and Huldah B. Daughtridge Memorial Scholarship. Originally supporting one student per semester, this scholarship now helps over 10 students each term—prioritizing North Carolina residents with financial need.

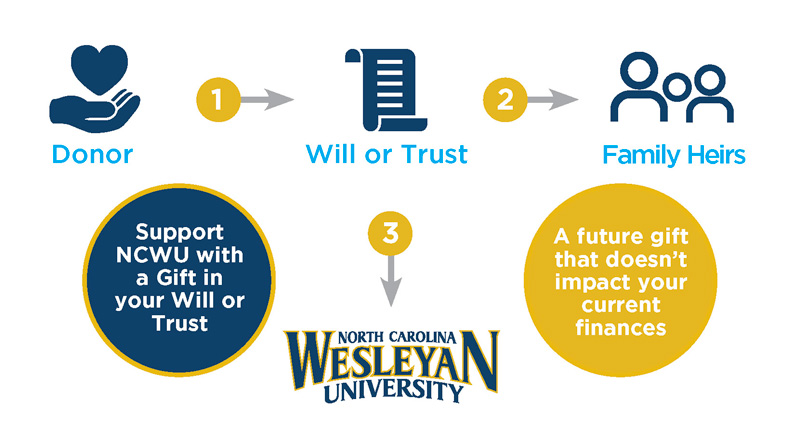

Planned gifts like these are more than financial contributions—they are legacies that honor the values of their donors and transform lives for generations. Whether through a bequest in a will, a trust, or a gift from an IRA, these contributions offer flexible, tax-smart ways to support NCWU’s mission.

Why Estate Planning Matters

Despite its importance, 64% of Americans do not have any estate planning documents, and only 34% have a will. The main reason? Procrastination.

Estate planning ensures your wishes are honored—whether for your family, loved ones, or favorite charities. It’s a key part of financial wellness and peace of mind.

5 Simple Steps to Get Started

- Inventory Your Assets – List everything you own and its value. Compile a list of all of your assets and their value. Once you’ve got it all organized you can start thinking about what to do with it.

- Set Your Priorities – Think about what matters most to you. Before you get down to the specifics of planning, consider your priorities and goals. What are you looking to achieve?

- Identify Beneficiaries – Decide who or what organizations you want to support. Make a list of the individuals and organizations that you want to provide for in your estate plan. Note any conditions that might determine the method and circumstances.

- Talk with Family – Discuss your plans with loved ones. If applicable, work closely with your spouse from the beginning. Coordinating plans between spouses often leads to additional savings for your estate. You may also want a meeting to discuss your plans with children or other family members.

- Seek Professional Help – A qualified attorney or advisor can guide you. Even if you only need a simple will, it is advisable to seek the help of a qualified attorney and, as needed, other professional advisors. Professional guidance is most often a worthy investment to ensure a proper plan.

Elevate the Next Generation at NCWU. Leave a Legacy Today.

If you care deeply about NC Wesleyan or are grateful for the education you or a loved one received, consider leaving a legacy through your will. This type of gift, called a bequest, is a meaningful way to support future generations.

Benefits of Planned Giving:

- Simple Process – Often just one sentence in your will.

- Flexible Options – Give a fixed amount, a percentage, or the remainder of your estate.

- No Impact on Current Finances – Your gift is made in the future.

- Purposeful Giving – Support a specific program or area of need.

- Adaptable – You can revise your plans if your situation changes.

Already Have a Will?

- That’s a great start! But there are other important steps to ensure your plans are clear and up to date:

- Do you revisit your will regularly to reflect major life changes like births, marriages, or divorces?

- Have you shared the location of your will, healthcare directives, and other key documents with a rusted person? Are they stored securely and organized?

- Are the beneficiaries listed on your retirement accounts, bank accounts, and insurance policies current?

- Have you considered your digital footprints such as online banking, email, cloud storage, and social media? Does someone you trust have access if needed?

So, don’t forget to:

- Update it after major life events.

- Share its location with someone you trust.

- Review your listed beneficiaries.

- Plan for digital assets like email and online accounts.

Maximize Your IRA’s Impact

If you’re 70½ or older, you may be able to make a Qualified Charitable Distribution (QCD) directly from your IRA to NCWU. This can:

- Count toward your Required Minimum Distribution (RMD).

- Be excluded from your taxable income.

- Reduce future tax burdens for your heirs.

Example: Linda, age 74, asked her IRA administrator to send $2,000 directly to NCWU. It counted toward her RMD and saved her on taxes—without affecting her current finances.

Choose Your Legacy Today

To GET STARTED or learn more about leaving a lasting legacy through a planned gift, visit ncwu.edu/planned-gifts or contact Tammy Robinson at 252.985.5410 or donorrelations@ncwu.edu.